File Reviews and their increasing importance in relation to SRA Regulatory Compliance

I know, I know. I heard the collective groans when people read the heading for this article. Unfortunately, file reviews have never been as important as they are now, with the Law Society Gazette full of headlines of situations which could have been avoided if effective file review and supervision were in place.

So, let’s start with the regulatory requirements for file reviews.

The SRA Code of Conduct for Solicitors, RFLs and RELs.

The Code specifies the following in Section 3 “Service and Competence;”

- You ensure that the service you provide to clients is competent and delivered in a timely manner.

- You maintain your competence to carry out your role and keep your professional knowledge and skills up to date.

- You consider and take account of your clients attributes, needs and circumstances.

- Where you supervise or manage others providing legal services:

- you remain accountable for the work carried out through them; and

- you effectively supervise work being done for clients.

- You ensure that the individuals you manage are competent to carry out their role, and keep their professional knowledge and skills, as well as understanding of their legal, ethical and regulatory obligations, up to date.

There is a further provision in the Code of Conduct for Firms similar to 3.5 b) which talks about “an effective system for supervising client’s matters.” (SCCF 4.4)

The question for the above would be, how can this be implemented and evidenced?

Yes…you guessed it…file reviews.

Of course, whoever is carrying out the file reviews needs to be competent to do so, otherwise they may not pick up on what the file is “telling” them for the review. And the worse “sin” of all file reviews – treating them as a tick box exercise which doesn’t evidence the word “effective.”

Because, to any person external to the firm who may look at these (such as the SRA, Lexcel or SQM auditors), it will be fairly obvious that this was the case.

File reviews can be much more than demonstrating effective supervision though.

Firms who are Lexcel accredited, or Conveyancing Quality Scheme members will know from the requirement to complete an annual risk review, that file reviews are an effective early warning system for identifying poor practice on files, and potential complaints. An example of this would be a review of the correspondence spike (or equivalent folder on a case management system), where the fee earner has not communicated with the client for an extended period following the initial instructions, despite evidence on the file where the client has been repeatedly asking for updates. (And believe me, that does happen!). File review analysis can provide excellent supervision data to feed back to fee earners to allow for continuous improvement.

Finally, as this article is about the increasing importance of file reviews in relation to regulatory compliance, it would be remiss not to include the biggest regulatory focus for the Solicitor Regulation Authority so far in this decade; the Money Laundering Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 and it’s various amendments to date.

The SRA have significantly stepped up their desktop and onsite audits in recent years, and for those firms in the scope of the Regulations, I have to say it’s quite unlikely that you will escape an audit from the regulator in one form or another. If you are the Money Laundering Compliance Officer (MLCO) then it is your responsibility to ensure that fee earners are complying with the requirements of the Regulations.

And how confident can you be about that?

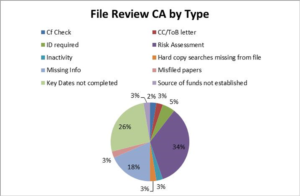

If the firm isn’t carrying out file reviews, or the ones they do carry out are carried out as a tick box exercise, you could be in for a very rude awakening. The SRA will call for files for either a desktop or onsite audit and review them. If there are multiple non-compliances, such as no evidence of Source of Funds or Source of Wealth on file, no client or matter risk assessment completed (or the risk of money laundering not assessed) or no effective evidence of Identification, then this raises the question by the Regulator about the “effective supervision” of client matters, as well as a whole host of unwelcome attention for the MLCO and the firm, which could result in disciplinary actions and fines.

Don’t become a headline in the Gazette.

Make sure the firm is completing its file reviews diligently, and using the corrective action information to continuously improve its compliance.

Let us help.

For some firms, file reviews are a chore given the pressures on fee earners which reduces the time available for file reviews.

Cpm21 has an outsourced file review service which can be tailored for your firm.

Click Here to find out more.